Reliance General Insurance Tops The Charts In Customer Loyalty

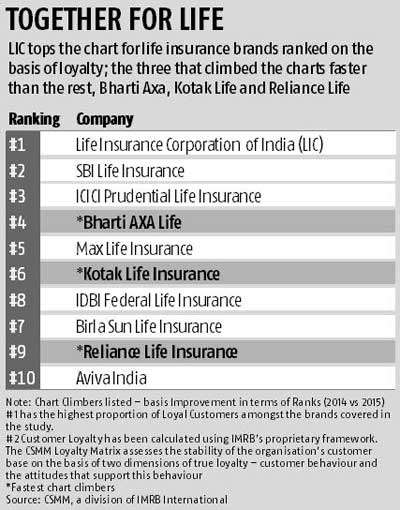

Fifteen years ago, when the insurance sector opened up and new players entered the space, it was believed that this was the beginning of the end for India's only life insurer at that time, Life Insurance Corporation of India (LIC). Turn to 2015, and the picture has turned out to be quite different. LIC still holds majority market share and, according to a survey by IMRB, its customers are also among the most loyal in the industry. It is top of the list of 10 insurance brands ranked on the basis of customer loyalty followed by SBI Life Insurance and ICICI Prudential Life Insurance at second and third place.

Loyalty is an important milestone for insurance brands, especially at a time when the industry's reputation has been marred by mis-selling and improper disclosures of returns by agents. Also given the brand clutter in insurance today and the difference between rival products often nothing more than a name, insurers have a tough fight keeping their customers loyal.

The Indian insurance industry has 24 life insurance companies, 28 general insurance companies and one reinsurance company. Given the large number of players and the fact that the premiums' pie is worth thousands of crores (Life insurers collected new business premiums of close to Rs 11,3140 crore in FY15), the annual syndicated customer satisfaction report by CSMM, a division of IMRB International assumes great significance. The report states, 'Customer loyalty has improved considerably in the market in terms of both service and product' and as per the 2015 survey, close to 60 per cent of the customers are 'truly loyal' to their insurance providers, which is significantly better than 2014.

What is it that makes a customer loyal to one brand over another? Better customer engagement says the report. No surprise then almost every insurer today invests heavily in customer engagement, be it through face-to-face interactions, faster claim payments or any other service. The aim is to ensure that customer experience is positive. And when it comes to life insurance, though LIC has scored over its private sector competitors, it would be myopic if it were to rest on its laurels. The survey shows that the fastest chart climbers are all from the private sector: Bharti AXA, Kotak and Reliance. Besides 8 of the top 10 are private sector players.

The private insurers are also top of the game in health insurance. Reliance, Bajaj Allianz and Apollo Munich have the most loyal customers according to Health Pulse, a syndicated Customer Satisfaction and Loyalty study by IMRB International's Stakeholder Management division. The report says that customers are impacted most by company reputation, agent experience, policy features/benefits and premium payment process.

Talking about Health Pulse, Praveen Nijhara, vice president & head-CSMM, IMRB International said, 'Our study findings reflect customer loyalty to be high and this is driven by some of the initiatives that have been introduced in the last few years. However, as per the report we do see that customer loyalty tends to dip post a few years and since the policy contract is renewed each year, it is critical for organisations to actively engage these customers.' The report he said, highlights that customers are not only looking at the brand and the health plan/policy on offer, but service as well.

LIC, Reliance General win the loyalty race Why does the private sector score over the public sector in health? It could be a combination of factors; even the nature of advertising employed by these companies has a role to play. 'The report indicates that private players are a better alternative not only on account of the product, network of hospitals, but they are also seen to bring to the table better service which uplifts the customer experience,' Nijhara said. Insurers willing to go the extra mile are the ones winning the loyalty race.